Hit with the real cost of college

Amanda, 18, wanted to go out of state but when she couldn’t get the loans she needed, she ended up at a community college.

I always imagined myself on my own at a college far from home, seeing new places and experiencing new things.

I felt I could go to any college I wanted because I had worked hard in high school. After my brother started at Cal Poly Pomona, I realized I would be paying for my education on my own since my parents didn’t pay for his because they couldn’t afford to. But I figured I could get scholarships and grants and pay for the rest with loans. Now that I look back, I realize I was too optimistic. I didn’t understand that the economy was so bad that it wouldn’t be that easy.

Since I didn’t know which colleges I wanted to apply to, my guidance counselor suggested I apply anywhere so I’d have options when I made my choice in the spring. She spent about five minutes with each student. She didn’t tell me to consider the cost of college or ask how much my family could afford.

I didn’t put that much effort into finding the perfect school. I looked into colleges that contacted me or I heard about from school presentations, and the ones my friends recommended.

I wanted to attend a private school where classes are smaller so you can approach the professors and ask for help, and possibly a school with religious affiliations because I wanted to take theology classes. So I applied to Cal Poly Pomona and Concordia University in Irvine (my backups if I stayed in California), Harvard (our school encourages kids to apply because it’s free for low-income students), New York University, St. John’s University in New York and the University of New Haven in Connecticut.

I didn’t know much about financial aid. In January, our school guidance counselors came into our classes and gave us a copy of the FAFSA (Free Application for Federal Student Aid) and explained the form. I knew it was how you apply for financial aid, which is money given to you to go to college depending on your family’s income. They said, “Some of you will get loans. Some of you will get grants or scholarships.”

I knew the private schools I had applied to cost more than public universities, but I thought I could get loans and pay them back later.

I got into a small East Coast school

I was rejected from Cal Poly Pomona, then waitlisted at St. John’s in December. I was at a family dinner at my grandma’s on Lunar New Year when I got an e-mail welcoming me to the University of New Haven. At first I was in shock. I turned to my cousin and said, “Oh my god Megan, look, I got in!”

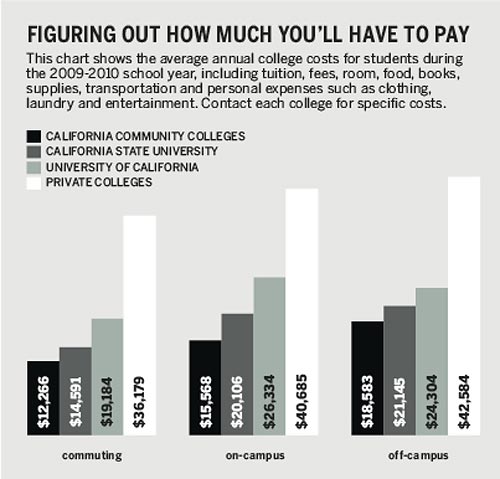

The cost of UNH for the 2009-10 school year was about $42,000, which included tuition, housing and meals. I thought I should wait for the financial aid letter to come before I figured out how to pay for it.

I received my financial aid award letter from UNH in May. Each semester I was to receive a $2,600 federal Pell Grant, $1,750 from a subsidized Stafford loan and $1,000 from an unsubsidized Stafford loan, plus a $9,000 grant from the university. Grants and loans covered 70 percent of costs. Each semester, I was expected to pay about $6,000.

There were parts of the award letter I didn’t understand so I had to Google them to find out what they meant. The first terms I searched were “subsidized” and “unsubsidized.” I learned that they are both government loans. The subsidized loan does not accrue interest until after you graduate, while the unsubsidized loan starts accruing interest right away. I discovered a grant was money I didn’t need to pay back. The university grant was given based on academic performance and the federal Pell Grant was given based on income.

I understood I would have to pay back the Stafford loans, plus the private loans I planned on taking out for the $6,000 I had to come up with each semester. But I did not add it up to figure out how much in loans I would need over four years ($70,000). I was just focused on paying for the first year.

The first time I visited UNH was for freshman orientation, the week after high school let out in June. The school was just as it looked in the pictures. It had a mix of new and old buildings. The older buildings were brick as most of the school was, and the newer buildings were more modern. I liked the small class sizes and academic opportunities like internships and study abroad. Although I was not used to the cold, gloomy, wet weather in June, I liked the small-town atmosphere (population 124,000) and the people. I met people from all over the East Coast and made new friends. After orientation, I felt that it was the school for me. I thought, “I can make this work.”

When I came back from orientation, I started thinking about paying for college. Neither of my parents went to college and they don’t speak English so they don’t understand how things work.

During the first week of July, I went to Wells Fargo with my dad to apply for a private student loan. The loan officer asked my dad and I questions regarding my parents’ and my credit history, employment info and debts. She came back 10 minutes later and told us our request for a collegiate loan was denied because our household income was too low.

The bad economy made it harder to get loans

As my dad and I were leaving, the loan officer said that right now the economy is bad and they can’t give out as many loans as they used to. She said, “If you came a few years earlier you probably would have gotten it.” I was sad. It was unfair. I’d done a lot of things, like taking AP and honors classes, doing community service and working part-time in a law office since I was 16. But because of the economy, I couldn’t come up with the money to go to the college I wanted.

After that, I tried Sallie Mae and U.S. Bank’s student loan programs and I got the same answer: I don’t qualify.

I contacted UNH and asked them for advice. They told me if I couldn’t pay tuition by Aug. 3 I should reconsider attending. I continued to do the assigned summer reading as I tried to think of ways to attend. I applied for a couple higher-paying jobs and scholarships, but I didn’t get them. I realized that UNH was not going to happen.

A week after tuition was due, on Aug. 11, I finally called UNH to notify them of my decision to withdraw. Twice I dialed the number, let it ring once or twice, then hung up. On the third call I finally found the courage to speak. After I told them of my decision, I felt sad and empty, like my life had just been paused. My college dreams were put on hold.

Now I live at home and attend East Los Angeles College. I’m tired because I work during the day and my classes are at night. After community college, I plan on transferring to Humboldt State or another four-year school to get my bachelor’s degree in psychology or administration of justice.

I’m disappointed I’m not at UNH this fall. I was really looking forward to moving out and living the college life. Yet at the same time I understand that the economy makes it harder for people to get loans because banks are not willing to take risks giving them out right now.

If I were to do something different, it would be to more thoroughly research ways to pay for college. My advice to students is to look into the costs of each school. Before you apply, look at the financial aid section on the school’s website. Some schools tell you how many students are on financial aid, showing you how much the school expects their students to pay. Also, have a backup choice that is more affordable and save money for personal expenses. What if you want to go out with friends or catch a movie?

I would also advise students not to rely on private loans because they are more difficult to get right now. Many public universities in California offer the same education at a fraction of the price as private, out-of-state schools. So if you want to explore a new place, you can go to school in a different part of the state.

Life can’t always be what you expect even if you work really hard. You learn to move on.

There are several factors to consider when determining how much a college will cost you to attend.

It may seem expensive, but most people don’t pay the full amount because of financial aid. The total cost of college minus your family contribution, which is how much you or your family can pay, equals your financial need.

To get financial aid, you must file a Free Application for Federal Student Aid (FAFSA). You’ll be awarded financial aid based on family income. Pick up a FAFSA form at your school’s college office or fill it out online at www.fafsa.ed.gov.

TYPES OF FINANCIAL AID:

• Grants are money you don’t have to pay back and are typically based on financial need. These include federal Pell Grants and Cal Grants. Get info about Cal Grants at calgrants.org.

• Scholarships are also free money for college you don’t have to pay back. Learn about which scholarships you qualify for at fastweb.com.

• Work-study lets you earn money through jobs on or off campus to help pay for your college costs.

• Loans are borrowed money you must pay back, with interest. There are different types of loans. The Stafford is a federal loan which can be subsidized (which means the government pays the interest while you’re in school) or unsubsidized (which means you pay the interest while you’re in school). Another type of federal loan is the Perkins Loan, which is need-based. There are also private loans for college, which you apply for through banks.

For more on this topic, check out:

Applying for financial aid. Starting early made it easier for Sasha, 19, and her parents. November – December 2008